How much have you thought about retirement? Does each paycheck find you wondering how you’ll scrape together a few spare dollars to tuck away for your golden years? Do all the options and account types and matching this or that and 401something make your head spin? Luckily, saving for retirement doesn’t have to be complicated – or cost you every free cent.

There are two main things to focus on: a general understanding of account types and how to fund said account.

Account Types

There are six main account types: 401K, IRA, SEP IRA, Roth IRA, Simple IRA, and others. The major differences between these accounts are if contributions are made pre- or post-tax, if you’ll be taxed when withdrawing for use (ideally, your well-funded retirement), and if your employer will be contributing or even matching funds.

The arguably vague “others” category encompasses more specific account types that are traditionally only available for certain career-paths or industries (think teachers, municipal employees, armed forces, etc.). If you fall into one of these categories, it is possible that a well-informed human resources representative or a financial advisor within your organization may be available to help you navigate the pros and cons of these accounts.

If you’re employed full-time, check in with your employer about retirement benefits and what they offer. It may not sound like a lot now, but even matching one, two, or three percent of your annual salary in a retirement account can really add up.

How to Fund a Retirement Account

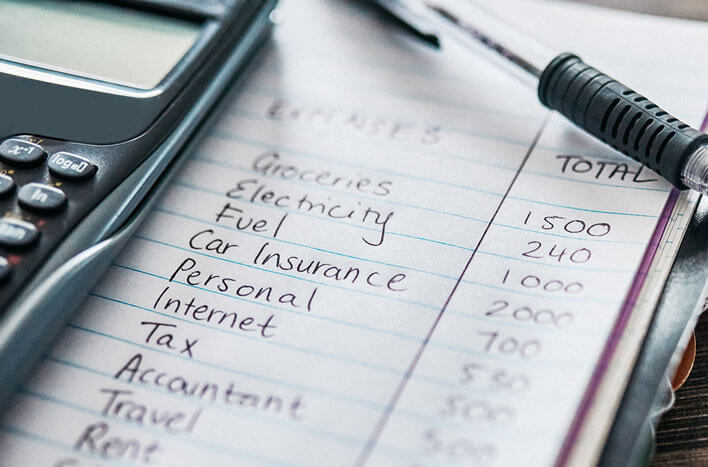

We at Stellar know that making and sticking to a budget can seem really daunting and tedious. Additionally, thinking about doing without a chunk of your income each month may seem impossible.

Don’t forget that through your Stellar account, you can always setup/change/update automatic transfers from one account to another. That means you set it up once and can forget about it until it's time to revisit down the line as appropriate.

Still not sure about doing without a portion of your monthly earnings? It’s less intimidating if you start small. Even small daily or monthly amounts can add up – especially if it’s matched by an employer and interest compounds in a proper retirement account.

Once you’re comfortable and see how easy it can be to make small adjustments and live monthly without those few dollars, it may be time to up the ante and increase your contributions. When you’re eligible for retirement and have a nice nest egg to live on, you’ll thank your wise-beyond-your-years younger self.

If you’d like to learn more about preparing for retirement, here are some resources to consider:

- Stellar Bank has a great series of retirement-related educational modules you can check out here.

- United States Department of Labor: Retirement Savings Toolkit

- AARP: Retirement Resources

- USA.Gov: Retirement Resources