How to Set a Personal Budget for 2023

Where does all your money go? A budget can show you how you’re spending, help you take control of your finances, and enable you to achieve your short- and long-term financial goals. While creating a budget may seem overwhelming at first, it is easier than you may think. Having a budget helps you get a clear picture of your income and spending, so you can decide the best way to allocate your money—like paying specific bills, going on a trip, starting an emergency fund, or saving for college.

Many people spend small amounts day to day (hello, coffee run) without even thinking about it. And those tiny, miscellaneous expenses can really add up. For example, you may be shocked when you see how much you’re spending at restaurants every month. The latest report from the U.S. Bureau of Labor Statistics shows that the average household spends more than $3,000 a year eating out.

Here’s how to create a personal budget in 6 steps.

1) Gather your financial information

Start by collecting your financial information—pay stubs, bank statements, receipts, and bills—so you can list out all of your expenses and income. Try to go back at least six months so you can make the most accurate predictions.

2) List your income

Income is any money you have coming in each month, such as your normal paychecks or any extra money you earn. Be sure to calculate your budget based on your net income, not your gross income. You want to use the amount of money after taxes are taken out. If you have a regular income, it’s easy to just look at your pay stubs. If you have an irregular income, such as a small business owner or an independent contractor, you can review your net income from the last few months and calculate your budget based on the lowest amount. You can always make adjustments if your income changes later.

3) List your fixed and variable expenses

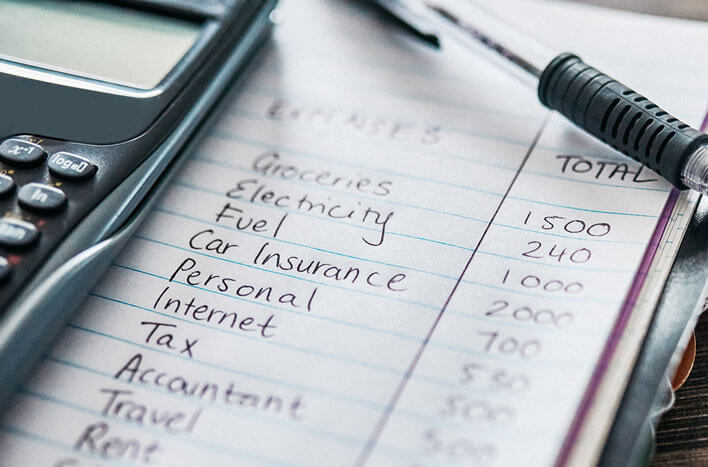

Begin by listing your fixed expenses such as rent, mortgage, insurance, car payments, or student loans. Next, list your variable expenses such as power, water, food, entertainment, and transportation. Be sure to record everything you spend, even if it seems minor. Your budget won’t be accurate if you’re not including every transaction.

4) Subtract your expenses from your income

While you’re calculating your budget, you may find that you have more expenses than income. This happens, but you can’t spend more than you make. Take some time to review all of your expenses and cut out anything extraneous. Be prepared to ask yourself some hard questions. Do you really need to eat out five times a week? Can you cut out any unnecessary subscriptions? If you’re down to your essential expenses, are there ways you could bring in additional income?

If you find you have money left after all of your bills and obligations, your budget surplus puts you in a great position. You can add extra money to your budget categories, put it toward your financial goals, or save it in an interest-bearing account like the Personal Savings Account at Stellar Bank.

5) Track your spending

There are many ways to track your spending, but the best way is the method that works for you. Whether you write down your spending in a notepad, create a spreadsheet, or sync your accounts to a budget tracker app, you’ll be able to see how much you’re spending in different categories and make any adjustments. Track your transactions on a regular basis, not just at the end of the month. If you take a look at your spending daily, or even at the end of the week, it’s much easier to keep yourself accountable and avoid overspending.

6) Make a plan for the future

Now that you’ve set some initial goals, plan ahead to see how you can reach them. For example, if you’re saving up for a new car, calculate how much you’ll need for your down payment and how that car payment would impact your future budget. You can also start planning for future variable expenses like summer vacation, holiday gifts, and unplanned maintenance costs.

Remember to review periodically

Once you’ve established your budget, it shouldn’t change much month-to-month. But it’s important to review it periodically to make sure you’re staying on track. Try to take a look at your income, spending, and savings at least every month so you can ensure your budget is still valid. For example, if you’ve started a side hustle, recently moved, or need to buy a new car, your budget will shift and you’ll need to make some changes.

You can find more budgeting strategies, tips, and tools—including a budget calculator—at the Stellar Bank Financial Education Center.