Insights

Fraud Prevention, Business Banking, Personal Banking Article

5 Types of Scams and Fraud to Watch Out For

Home Loans Article

5 Questions to Ask Before Buying a Home

Business Banking, Personal Banking Article

The Lifecycle of a Community Bank

Personal Checking,Personal Savings Article

Retirement 101

Business Banking, Personal Banking Article

Taxes 101

Personal Savings, Business Savings Article

Financial Literacy Tips for Businesses and Individuals

Online Banking, Treasury Management Article

ACH Transactions: What Every Small Business Should Know

Business Loans, SBA Loans Article

Grow Your Business with Commercial and Industrial (C&I) Loans

Personal Savings Article

Meaningful Family Conversations About Money

Online Banking, Treasury Management Article

The Business Benefits of Treasury Management

Business Savings Article

Retirement Planning for Small Business Owners

Business Loans Article

How Small Businesses Can Manage Seasonal Inventory and Working Capital

Personal Checking, Business Checking Article

6 Tips for Preventing Overdraft Fees

Business Loans, Business Checking, Business Savings, SBA Loans Article

Essential Small Business Start-Up Guide

Home Loans Article

Considering Homeownership?

Fraud Prevention,Online Banking Article

Banking and Online Security

Treasury Management Article

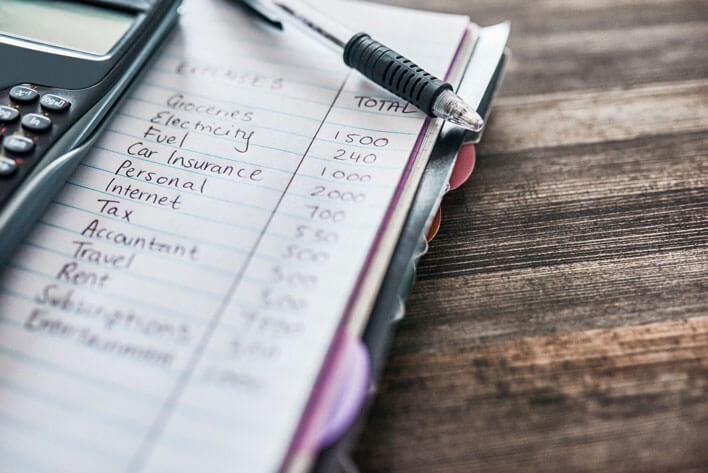

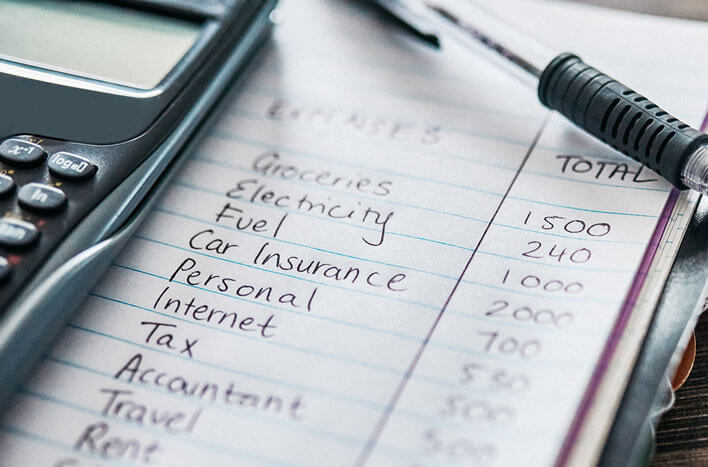

6 Steps to Create a Budget for Your Small Business

Treasury Management Article

How to Analyze Your Small Business Budget

Personal Credit Cards, Personal Savings Article

Financial Tips for a Stress-Free Vacation

Personal Credit Cards, Personal Savings Article

Financial Tips for a Stress-Free Vacation: Part 2

Business Banking, Personal Banking Article

5 Benefits of Relationship Banking

Treasury Management, Business Checking Article

Why It's Important to Separate Personal and Business Finances

Fraud Prevention, Business Banking, Personal Banking Article

Protect Your Business and Personal Finances from Phishing

Personal Banking Article

Mindful Living

Business Banking Article

Facing the Ups and Downs of Business Together

Business Banking Article

How to Write a Business Plan That Sets You Up for Success

Personal Banking Article

Managing Finances Through the Loss of a Loved One

Factoring Article

Alternative Financing Options – Is Factoring Right For Your Business?

Business Banking Article

Financial Wellbeing for Entrepreneurs

Personal Banking Article

How to Set a Personal Budget for 2023

Personal Banking, Business Banking Article

Stellar Bank to Provide Enhanced Online Security with a Verified .BANK Website Domain

Business Banking Article

Why an annual financial check-up is crucial to business success

Business Loans, Business Banking, SBA Loans Article

Thinking about Franchise Ownership? Here’s What to Consider and How Banking Can Help

Services Article

It’s National Volunteer Month! Here’s How You Can Get Involved and Give Back

Treasury Management, Services, Business Banking Article

Four Ways Treasury Management Services Can Help Your Business Thrive

Services, Personal Banking, Online Banking, Personal Checking Article

Financial Literacy Tips to Prepare Young Adults for the Real World

Services, Home Loans Article

Loan Options to Get Your Home Renovations Moving

Services, Business Banking, Business Checking, Business Savings, Business Loans Article

Staying Power 101: How to Ensure the Longevity of Your Small Business

Services Article

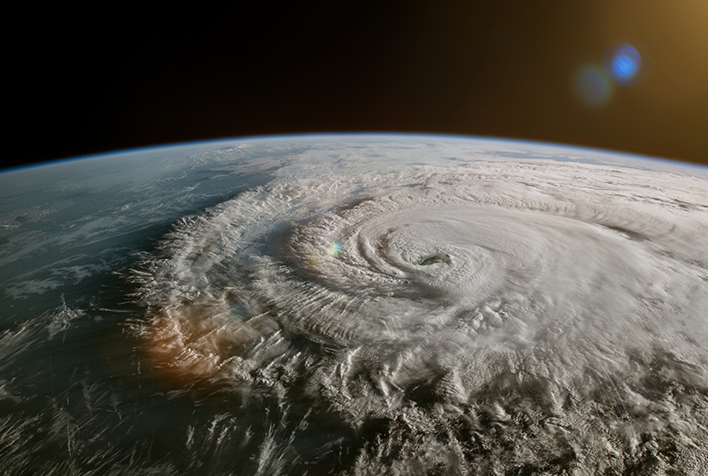

Prepare Your Small Business for Hurricane Season

Services, Personal Banking, Personal Checking Article

6 Money Saving Tips for Moving

Employee Spotlight Article

Q&A with Stellar Bank Credit Analyst Kameron Pree

Business Banking, Fraud Protection Article

Defending Your Small Business Against Cyber-Attacks

Fraud, Online Banking Article

Send Yourself Money? That’s a Big Red Flag

Business Banking, SBA Loans, Business Loans Article

Resources and Support for Veteran-owned Small Businesses

Business Banking Article

Small Business Spotlight: Paige PR Discusses Why Stellar Bank is an Essential Part of Their Team

Business Banking Article

Opportunities and Support for Minority Entrepreneurs

Employee Spotlight Article

Stellar Stars: David May on making a difference through Adaptive Sports for Kids

Fraud, Fraud Protection, Fraud Prevention Article

10 Tips for Safer Online Shopping This Holiday Season

Fraud, Fraud Prevention, Fraud Protection Article

How to Determine if a Donation Appeal is for Real – or a Scam

Business Banking Article

Six Planning Tips for Small Business Success in 2024

Business Banking Article

The Crucial Role of Strategic Planning with Your Banker

Fraud Prevention Article

How You Can Take Control of What Data You Share in 2024

Business Banking Article

How Giving Back Helps Small Businesses Grow

Fraud, Fraud Protection, Fraud Prevention Article

How Scammers Use Social Engineering to Steal Money

Fraud, Fraud Prevention, Fraud Protection Article

Threats to Turn Off Water and Power Could Be the Work of Scammers

Business Banking, Business Checking Article

Customer Spotlight: Literacy Now

Stay Updated On Important News

Sign up for our newsletter to see latest news and insights from our business banking experts, from financial literacy to fraud trends.

Explore Other Resources

Local People Who Are Ready to Help

We’re here for you, when and where you need us. You can call us anytime. You can make an appointment to meet at one of our banking centers. Or you can just stop by whenever it’s convenient.